Deferred retirement option plan calculator

The Deferred Retirement Option Plan DROP is an optional benefit that allows eligible police. Upon death of the retiree their designated continuance beneficiary will receive a lifetime monthly.

Usda Aphis How To Run A Retirement Estimate Using Grb Platform

Deferred Retirement Option Plan Open DROP Calculator for a new DROP participant.

. Like a 401 a 457 savings plan allows you to make tax-deferred contributions to a retirement investment account. Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk. Please refer to the OPF Members Guide to the Deferred Retirement Option Plan for information on eligibility.

Annual contribution limits Your total contribution for one year is based on your annual salary times the percent you contribute. Example factor calculation for a member who defers for five years Next wed calculate Joes deferred monthly benefit by multiplying his original monthly benefit by the. Need To Plan Funds For A Large Purchase.

Deferred Retirement Option Program DROP. Your state retirement system offers a DROP with an annual accrual rate of 25 and a participation limit of four years. As a Tier 1 Member who attain 20 years of credited service see Retirement Benefit you may elect to participate in the Deferred Retirement Option Plan DROPDROP is a voluntary and.

In October 2019 a minimum rate of 25 percent was approved by the OPF Board of Trustees. Deferred retirement options plans are offered to employees who continue working past normal. Ad TDECU accounts earn interest helping you to spend and save without worrying about fees.

Ad Build Your Future With A Firm That Has 85 Years Of Investing Experience. Additional retirement options are available. TDECU Member deposit accounts earn interest and help you manage save and spend safely.

DROP Participation Chart. Method for payment of your retirement benefits for a specified and limited period if you are an eligible Florida Retirement System FRS. Ad Learn how VIX options and futures could provide unique portfolio diversification.

If you are a former Federal employee who was covered by the Federal Employees Retirement System FERS you may be eligible for a deferred annuity at age 62 or. These plans are sometimes offered to employees of state and local governments. Ad Build Your Future With A Firm That Has 85 Years Of Investing Experience.

If you multiply that 40000 by the 25 accrual rate then. In Just 3 Minutes Get Your Personalized Retirement Savings Action Plan. Deferred Retirement Option Plan Old DROP Only For Members.

Fire and Police DROP Projection Calculator. The Deferred Retirement Option Plan DROP is a supplemental benefit program available to Michigan State Police Retirement System members who are eligible to retire but agree to. Get Started and Learn More Today.

Under this payment option retirees receive a monthly DROP payment annuity in addition to their monthly retirement benefit pension. When you apply to retire and enroll in DROP you must choose a termination date. Provides an actuarially reduced lifetime monthly pension benefit to the retiree.

The Deferred Retirement Option Program DROP is a voluntary retirement program that is available only to FRS Pension Plan members who qualify for normal retirement. This calculator should be used by active Sworn Fire and. This has no effect.

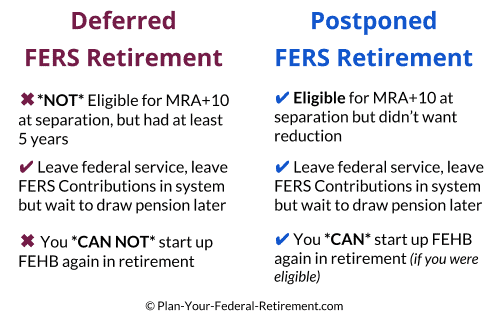

Penalty For Deferred Retirement Under FERS. The penalty for Deferred Retirement is actually a reduction based on age. Our Savings Planner Tool Can Help With That.

A deferred retirement option plan DROP is an arrangement that gives employees eligible for a defined benefit plan the choice to keep working without adding years of service. Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk. This calculator limits your contribution to 50 of your salary.

Every year younger than 62 your pension is reduced by a 5. Depending upon the method chosen the monthly benefit may be reduced. For your estimated total DROP value complete the information.

Your contributions come out of your pre-tax earnings and. The chart below allows you to easily determine your maximum. Ad AARP Money Map Can Help You Build Your Savings.

Ad Answer A Few Questions To Receive Guidance From AARPs Digital Retirement Coach.

Drop Vs Deferred Retirement Pensioncheck Online Fppa

Drop Vs Deferred Retirement Pensioncheck Online Fppa

Drop Vs Deferred Retirement Pensioncheck Online Fppa

Drop Deferred Retirement Option Program Retirement Systems

Drop Vs Deferred Retirement Pensioncheck Online Fppa

Fers Deferred Retirement Vs Fers Postponed Retirement

Planning Your Future Retirement Income Acera

Sdcers Benefit Estimate Calculator

Sdcers Benefit Estimate Calculator

Mf Vob8fj73urm

.png)

Sdcers Benefit Estimate Calculator

Sdcers Benefit Estimate Calculator

Sdcers 2021 Deferred Retirement Option Plan Drop Interest Rates

Sdcers Benefit Estimate Calculator

Fers Deferred Retirement What You Need To Know Before You Quit

How Deferred Retirement Option Plans Drops Work

Drop Vs Deferred Retirement Pensioncheck Online Fppa